On behalf of greater than 3,500 corporations engaged in sheet metallic and air-con development, Sheet Steel and Air Conditioning Contractors’ Nationwide Affiliation (SMACNA) just lately introduced it applauds passage of H.R. 7024, the Tax Aid for America’s Households and Employees Act. In an announcement from Aaron Hilger, CEO of SMACNA, he known as it an “important piece of laws that extends and reforms the R&D credit score, bonus depreciation and tools expensing.”

Learn the remainder of his assertion under:

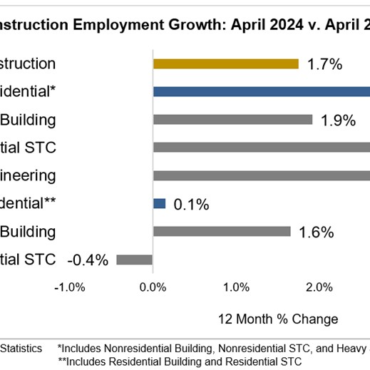

Our contractors have seen an historic demand to buy costly however extremely productive new tools to satisfy venture calls for, as a result of speedy growth of mega tasks following the bipartisan infrastructure legislation, CHIPS and Science Act and different IRA associated personal sector tax incentives for vitality environment friendly retrofits. The bipartisan assist and passage of the invoice, which renews and extends the 100% bonus depreciation and 179 tools expensing reform, is critical as a result of strong and file setting development of the development, CHIPS, vitality effectivity and manufacturing industries over the past two years.

I’m grateful to all those that performed a task within the profitable negotiations, together with Home Methods and Means Chairman Jason Smith (R-Mo.), Senate Finance Chairman Ron Wyden (D-Ore.), and the various members of our business who’ve helped Congress perceive the intense significance of those incentives to permitting our corporations to maximise productiveness with a extremely skilled workforce working extremely advanced and exceptionally costly tools.

At a time when our corporations are engaged on and bidding the most important tasks within the nation, we are actually in a stronger place to beat operational obstacles as a result of lapse or lowered worth of three key provisions within the tax code straight impacting purchases of superior technological tools. These crucial tax incentives are of significant significance to the nation’s constructing and development business right this moment and sooner or later:

Retroactive Extension of the 100% Bonus Depreciation – Restores the 100% bonus depreciation for certified property, as a substitute of the present 20% annual part down that went into impact on January 1, 2023.

Retroactive Extension and Permanence for 174 Analysis and Growth Expenditures – Permits corporations to instantly deduct R&D bills as a substitute of amortizing over 5 years.

Increase Part 179 expensing and curiosity deductibility for small companies—Will increase the utmost eligible quantity of funding and prolong the purpose at which the profit phases out.

On behalf of the three,500 Sheet Steel and Air Conditioning Development corporations SMACNA represents, I applaud the bipartisan passage of the Tax Aid for America’s Households and Employees Act, which extends and reforms very important tax incentives that assist the historic demand on our business to buy costly, productive new tools wanted to construct a powerful infrastructure that meets the nation’s wants now and into the long run.

Whether you require installation, repair, or maintenance, our technicians will assist you with top-quality service at any time of the day or night. Take comfort in knowing your indoor air quality is the best it can be with MOE heating & cooling services Ontario's solution for heating, air conditioning, and ventilation that’s cooler than the rest.

Contact us to schedule a visit. Our qualified team of technicians, are always ready to help you and guide you for heating and cooling issues. Weather you want to replace an old furnace or install a brand new air conditioner, we are here to help you. Our main office is at Kitchener but we can service most of Ontario's cities

Supply hyperlink

Add Comment