✕

Despite all of the economic uncertainty and a decline in consumer sentiment, the home service industry is remaining resilient to all that’s being thrown at it, according to a newly released study.

According to the report compiled by Jobber, a provider of home service management software, consumers are spending more intentionally, and those trends are likely to continue, but inflation subsides and potential rate cuts could be a boon for aging housing stock, and therefore, the HVAC industry.

“HVAC contractors are navigating a challenging 2024 with flat revenue and declining new work, as weak consumer sentiment and high interest rates delay purchases,” explains Abheek Dhawan, Senior VP, Strategy & Analytics at Jobber. “However, potential rate cuts could drive new growth in the near future. Additionally, the aging housing stock across the U.S. presents a significant opportunity for HVAC contractors. While current economic challenges have tempered growth, the need for critical system replacements and upgrades will continue to drive demand in the medium to long term.”

With Jobber’s network of more than 200,000 residential cleaners, landscapers, HVAC technicians, and more, using the software to keep track of jobs and bill customers, the company’s Home Service study is uniquely positioned to paint an accurate picture of what’s happening on the ground.

With consumers fighting an economic battle on two fronts — inflation and the lingering effects of all things COVID — Jobber’s newly-released study takes a deep dive into consumer sentiment and spending, along with some predictions for the future.

Key Takeaways

While consumer demand has continued to cool, it still saw single-digit growth in 2024’s Q1 and Q2. The study noted consumers are starting to feel more financial pressure and have pulled back spending, but service providers are still seeing growth, primarily due to increased average invoice size.

Click graph to enlarge

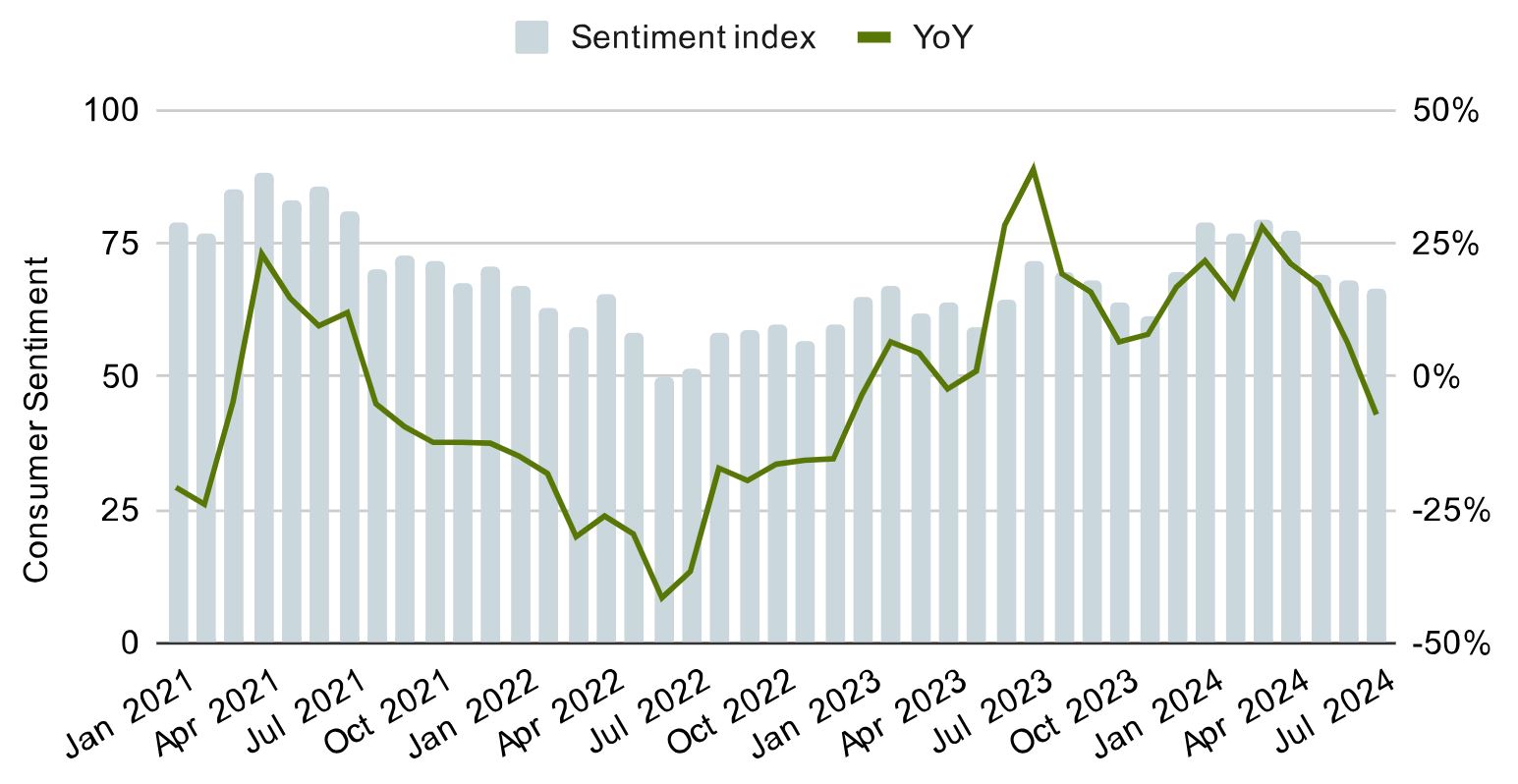

Index of consumer sentiment — year-over-year. (Courtesy of Jobber)

“The rise in median revenue has been driven primarily by increases in average invoice size as new scheduled work has been lower in all months this year relative to last year, besides a particularly strong February and April,” the report states. “As 2024 is a leap year, a portion of that increase in February is due to the extra day versus last year. A more cost-conscious consumer is driving part of this weakness.”

Real Disposable Income, or what’s left in a consumer’s pocket after taxes, when adjusted for inflation, “slowed to a crawl this year.” No surprise, but that has also resulted in a dip in consumer sentiment toward the economy and their personal financial situation, to decline.

Click graph to enlarge

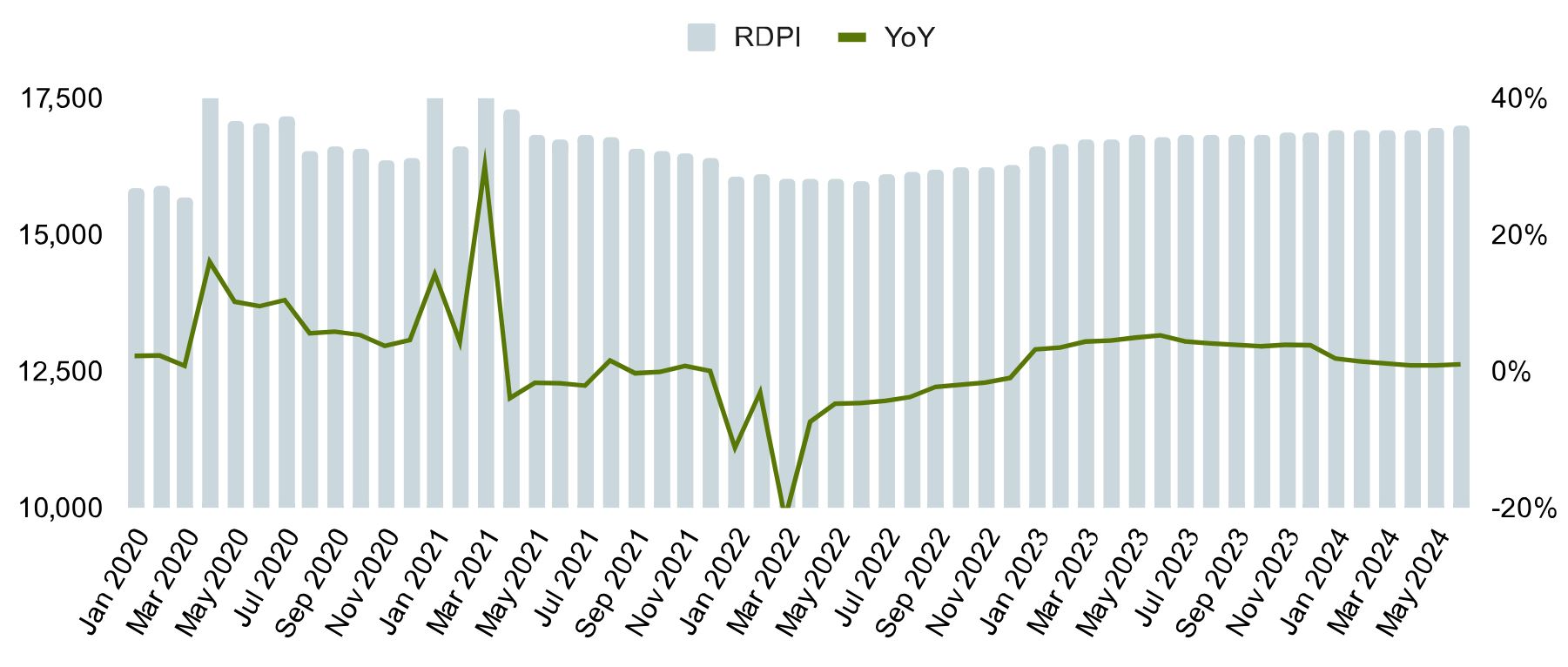

Real disposable income ($Billions). (Courtesy of Jobber)

“Going forward, however, many experts predict spending should pick up in the second half of 2024 and in 2025 as inflation subsides and the Federal Reserve cuts interest rates,” the study states. “This should have a particularly strong effect on housing and home services as mortgages and financed home improvement projects become more affordable. The timing and pace of interest rate cuts still remain highly uncertain.”

The housing market, which is intrinsically linked to the HVAC sector, saw home equity values continue to rise despite interest rates remaining high, which the study said is partially due to an undersupply of inventory in the U.S.

Click graph to enlarge

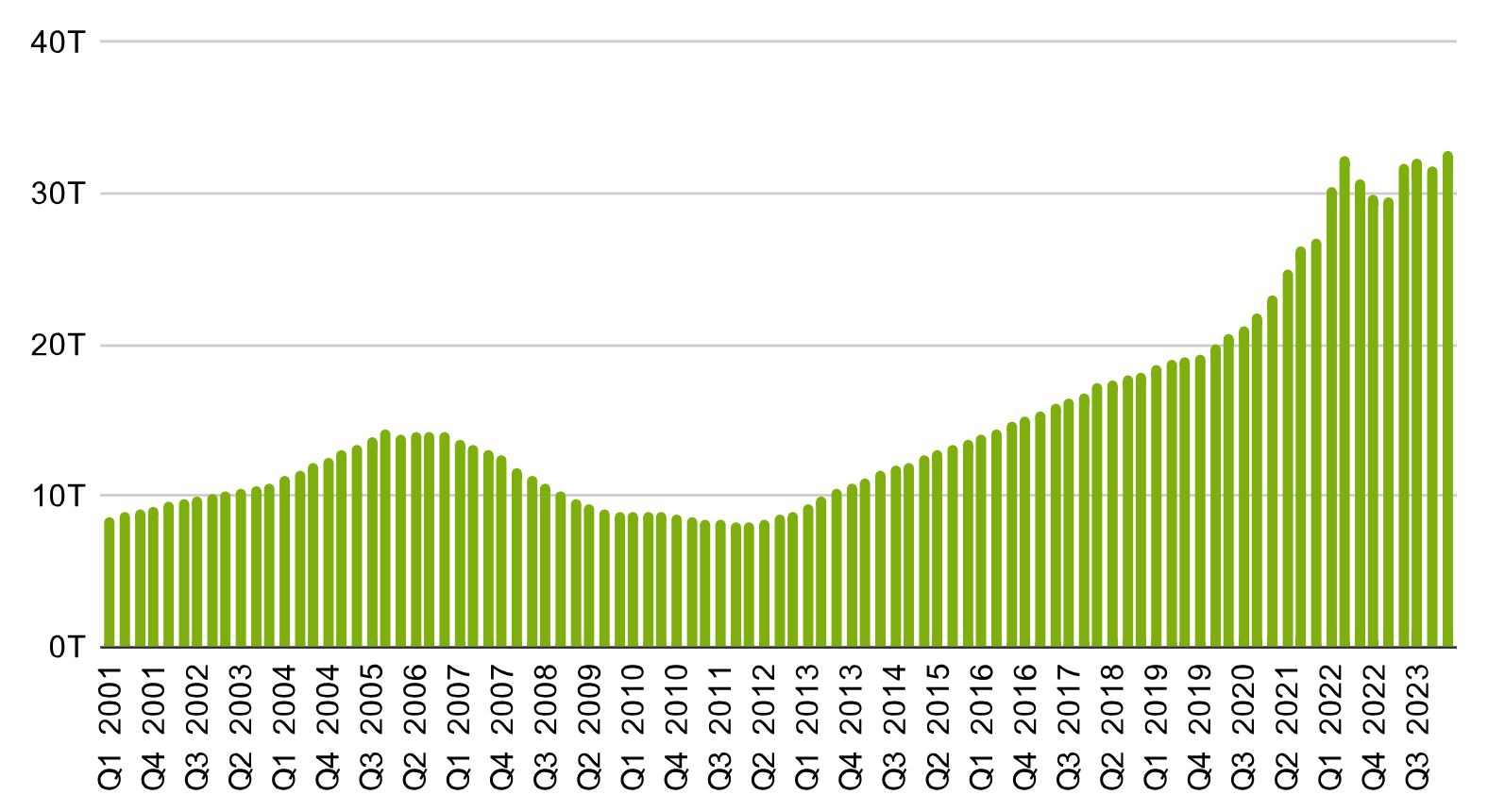

Home equity values ($Trillions). (Courtesy of Jobber)

“As well, monthly construction spending has mostly increased so far this year. New permits and housing starts, however, have slumped in the past few months which will have an effect on homes available for purchase in the coming few quarters,” the study states. “New home purchases are closely linked with home service spending presenting some headwinds for home service demand for the rest of 2024 and 2025.”

The contracting segment, which includes trades such as arborists, electricians, handymen, HVAC, plumbers, and other non-construction contractor services, had mixed results as far as new work scheduled and revenue growth were concerned.

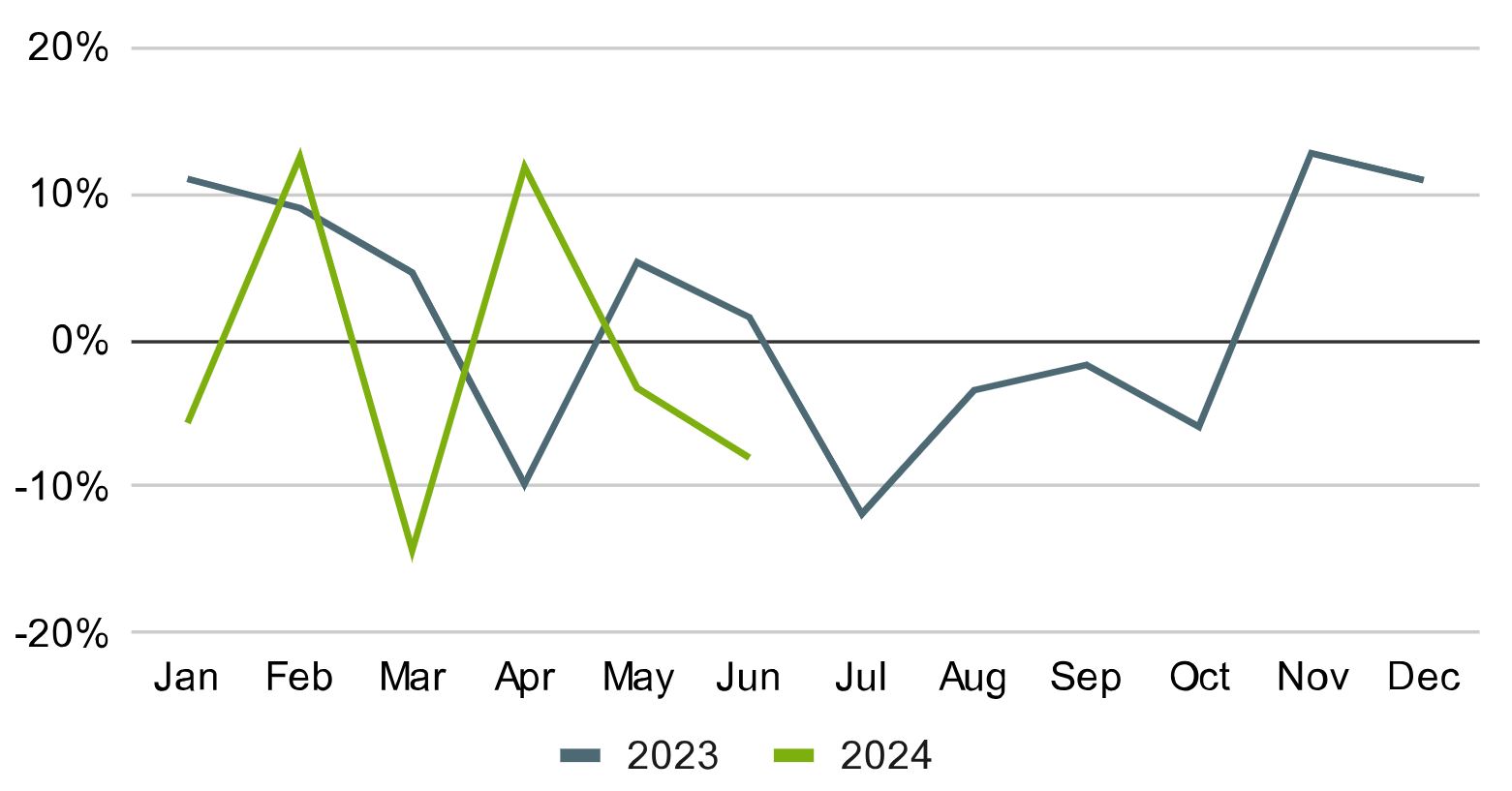

“Contractors had a particularly strong February and April increasing revenues 5% and 11% in those months, respectively,” the report states. “However, declines in other months resulted in this segment having flat growth through the first half of 2024.”

Click graph to enlarge

Median revenue contracting — year-over-year. (Courtesy of Jobber)

For construction, another service with inseparable ties to HVAC work, had the largest decline in new work, but declined less than in the same period last year. Construction, in this instance, includes residential and commercial construction, remodeling, and related industries.

“Construction tends to be the most expensive service and likely to be impacted by high interest rates,” the report states. “This may explain why the segment is the hardest hit, but also started strengthening as inflation eased and the first interest federal reserve rate cuts started to become more likely.”

Click graph to enlarge

Median revenue construction — year-over-year. (Courtesy of Jobber)

As for what the future holds, the study predicts that, despite the current economic challenges, there are still signs of recovery and potential growth in the home service industry.

“As financial conditions improve in the latter half of 2024 and beyond, consumer spending is expected to increase, particularly in housing and home improvement services, aided by potential interest rate cuts,” the study states. “The housing market remains a crucial factor influencing these trends, and the shift towards more manageable home improvement investments in the face of broader economic uncertainty reflects cautious optimism from consumers. Long-term, aging homes, which require significant updates, will continue to drive demand for home services.”

The study also states that experts predict consumer spending will increase in H2 2024 and 2025 as inflation subsides and potential interest rate cuts take effect, boosting housing, and home services.

Whether you require installation, repair, or maintenance, our technicians will assist you with top-quality service at any time of the day or night. Take comfort in knowing your indoor air quality is the best it can be with MOE heating & cooling services Ontario's solution for heating, air conditioning, and ventilation that’s cooler than the rest.

Contact us to schedule a visit. Our qualified team of technicians, are always ready to help you and guide you for heating and cooling issues. Weather you want to replace an old furnace or install a brand new air conditioner, we are here to help you. Our main office is at Kitchener but we can service most of Ontario's cities

Source link

Add Comment