✕

The HVAC industry is undergoing a significant transformation, as 2025 marks a pivotal milestone in the phasedown of high-GWP refrigerants. As of December 31, 2024, manufacturers ceased producing and importing residential and light commercial air conditioning and heat pump systems using R-410A, and new systems now feature mildly flammable (A2L) refrigerants, such as R-32 or R-454B.

This transition is set to reshape the market, as contractors adapt to installing and servicing new systems that contain A2L refrigerants. At the same time, economic pressures such as persistent inflation and elevated interest rates could continue to pose challenges in 2025. Although initiatives like the Inflation Reduction Act (IRA) and ongoing decarbonization efforts may create opportunities for growth, fueling manufacturers’ optimism for the year ahead.

The Economy

It’s challenging to predict how the economy will impact the HVAC industry in 2025 and to what degree, but inflation and interest rates have certainly been a factor, said Dustin Gregoire, director of HVAC sales and key accounts at Bosch Home Comfort. He added that, as with most market forecasts, a degree of uncertainty always remains.

“The first two quarters of the year will serve as a more definitive indicator of where the market is trending,” said Gregoire. “There is also the A2L transition to consider. The phaseout of R-410A systems is a new chapter for all of us, yet with change comes the potential for new opportunities as well. Bosch Home Comfort is committed to keeping a close eye on the changing market and remaining adaptable, agile, and innovative into 2025.”

Areas of opportunity include the residential market, which Bosch expects to remain stable with mild potential for growth, said David Lopes, director of marketing and business strategy at Bosch Home Comfort.

STABLE GROWTH: Bosch expects the residential market to remain stable this year, with mild potential for growth. (Courtesy of Bosch Home Comfort)

“This does, of course, always depend on a variety of factors. For example, the residential housing market is heating up, which paves the way for more new construction business, as well as replacements. With the rising cost of single-family homes, we are seeing a transition in residential construction to multifamily housing. On the commercial and industrial side, data shows consistent growth, specifically in the data center space, and our anticipation is that this trend will continue.”

Carrier is also seeing significant gains in the multifamily and light commercial spaces, particularly in retirement communities, said Nick Arch, vice president and general manager of residential HVAC solutions at Carrier. On the residential side, he added that Realtor.com predicts more single-family homes will be built in 2025 than any other year since 2006; however, that could be influenced by potential changes to interest rates and home affordability.

“As we look at 2025, we’re particularly focused on how interest rates impact home purchasing and residential new construction,” said Arch. “Keeping federal incentives in place to support high-efficiency HVAC system adoption is critical to offset inflation and higher financing interest rates. Early consumer spending trends will help determine the appetite for higher tier solutions and add-ons such as whole-home purifiers.”

LG sees 2025 as being a tale of two halves, said Steve Scarbrough, senior vice president and general manager of LG Air Conditioning Technologies USA.

“There’s really nothing stimulating the industry going into the first half of 2025, so it will be similar to what we’ve experienced in 2024 and even 2023. This will be compounded by refrigerant changes that will make things more challenging. We can expect commercial construction will still be flat, given factors such as interest rates and other economic uncertainties.”

IMPROVING CONFIDENCE:LG anticipates that by the second half of 2025, consumer confidence will begin to improve, which could provide a boost to the residential market. (Courtesy of LG)

Something to be aware of, said Scarbrough, is that consumers and contractors alike are facing confusion and uncertainty in the market, and questions like, “Should we fix or replace?” are common. However, he anticipates that by the second half of 2025, consumer confidence will begin to improve, potentially supported by better economic conditions, which could provide a boost to the residential market.

“For the residential market, we have what is called a 10-year replacement trend,” said Scarbrough. “If you go back historically, we see peaks and valleys on the replacement side of the residential business every 10 years. This 10-year cycle is coming about in the second half of 2025. So, what does all this mean? Again, I don’t expect the first half of next year to look much different than 2024, but I think key factors like tax cuts and interest rate reductions will help stimulate the residential side of the business in late 2025 and then 2026. Hopefully, that will translate to the commercial side of the business as well.”

Refrigerant Transition

The transition to A2L refrigerants means OEMs are rolling out an entirely new lineup of products. Trane, for one, is excited about 2025 and its new residential product portfolio, which features upgrades to its high-efficiency heat pumps and air conditioners, said Vijay Deshmukh, vice president of product management, residential HVAC at Trane Technologies. The new lineup also includes next-generation refrigerant that has 78% less GWP than R-410A.

“We’re entering the year with re-engineered products for the R-454B refrigerant, designed for even higher efficiency to enable homeowners to meet their heating and cooling needs while reducing their energy costs and carbon footprints,” said Deshmukh. “We have smoothly transitioned our residential products from R-410A to R-454B, with all units exceeding safety standards. Ahead of federal regulations, we deployed a phased approach throughout 2024, beginning with our 15 SEER2 heat pump. We will also continue supporting our customers and their R-410A systems through parts, service, and repairs.”

LG’s first A2L product hit the U.S. market in late 2024, said Scarbrough, which is when partners placed pre-season orders for the new products.

A2L PORTFOLIO:Bosch has been focused on transitioning its portfolio to A2L and providing training and education on these solutions. (Courtesy of Bosch Home Comfort)

“We also did a last call for the R-410A product in the summer of 2024 to allow our partners to finish up some projects and things they have in the works. Moving forward, clearly, our focus is the new A2L refrigerant, and our expectation is that as we get to the end of the first half of 2025, we will have 100% transitioned over.”

Carrier’s A2L heat pumps were introduced in March 2024, and the rollout of new equipment has been smooth, said Arch. He said the company has spent this last year changing over inventory, preparing distributors for the phaseout of new R-410A systems, and ensuring contractors are ready for updated installation and servicing practices.

“An R-410A system can be installed until December 31, 2025, as long as both indoor and outdoor were manufactured/imported into the U.S. prior to January 1, 2025,” said Arch. “Therefore, new R-410A systems will be available until pre-2025 built inventory is depleted, which will vary by location. R-410A service parts, such as compressors and evaporator coils, will remain available to service existing systems. In Canada there is not yet a rule limiting the refrigerant GWP allowed in equipment, so R-410A systems will remain available for Canada until such rule is enacted.”

Bosch launched its first A2L solution on the market in Spring 2024. Throughout 2024, Gregoire says that the Bosch team has been focused on transitioning the portfolio to A2L and providing training and education offerings on these solutions, while also addressing customer questions regarding the availability of R-410A systems in 2025.

“The deadline for producing and importing R-410A systems was December 31, 2024,” he said. “Our expectation is that manufacturers will have shipped the majority of their R-410A inventory available by the end of Q1. We expect R-410A inventory to be available to contractors through distributor inventory into Q2 of 2025.”

Regarding the rollout of Bosch’s new A2L equipment, most of it was ready for launch by Q3 or Q4 of 2024. Lopes said that the launch has gone smoothly, despite the industry’s initial challenge in clarifying EPA implementation dates. In response to manufacturer concerns, the EPA extended the sell-through period for previously manufactured R-410A equipment to January 1, 2026. This extension provided significant relief to the industry, he said, spreading the anticipated impact of the regulation from 2024 into 2025 and easing the transition.

“It’s been a challenge for manufacturers and their suppliers, as they try to balance demand for non-A2L products while also focusing on ramping up production for new A2L-compliant products,” said Lopes. “Now it’s a question of how fast the market will run with those new A2L systems versus continuing to tap existing inventories in the supply chain between manufacturers, distributors, and contractors.”

Regulations and Trends

Looking ahead, manufacturers are closely monitoring the potential impact of the Trump administration on the Inflation Reduction Act (IRA), as well as his proposed tariffs. The new administration could also influence the ongoing trend toward electrification and decarbonization, shaping policies and incentives that drive these efforts.

Carrier expects the electrification and decarbonization trend to remain a strong focus in the immediate future, though legislative or regulatory changes could affect these initiatives, said Arch.

PHASEOUT PREPARATION: Carrier has been preparing distributors for the phaseout of new R-410A systems and ensuring contractors are ready for updated installation and servicing practices. (Courtesy of Carrier)

“Carrier remains committed to developing sustainable solutions that are better for our people and planet for generations to come,” he said.

Regarding the IRA, Arch noted that it’s currently business as usual, with contingency plans in place depending on legislative/regulatory changes in 2025.

“Consumers who live in states with existing IRA programs should take advantage of the available rebates and credits now in the unlikely event funding is retracted at the federal level later,” he said.

It is too early to comment on the future of the IRA, given that the new administration is still being formed, said Gregoire.

“What we can say is that as we have with the previous and current administrations, we will strive to be a technical resource to authorities in the United States as they consider the impact of policy and regulation into the future.”

That said, Gregoire believes the IRA has played a greater role in increasing awareness of higher-efficiency HVAC solutions rather than generating consumer demand for energy-efficient technologies. “This is largely due to the considerable stability of add-on/replacement (AOR) residential business, which comprises about 80% of the overall U.S. HVAC market,” he said. “It is also important to consider the role that state and local incentives can play.”

As state rebate programs under the IRA gain approval, Trane expects a significant impact on the residential HVAC market, enabling dealers and contractors to offer energy-efficient systems to homeowners, said Deshmukh.

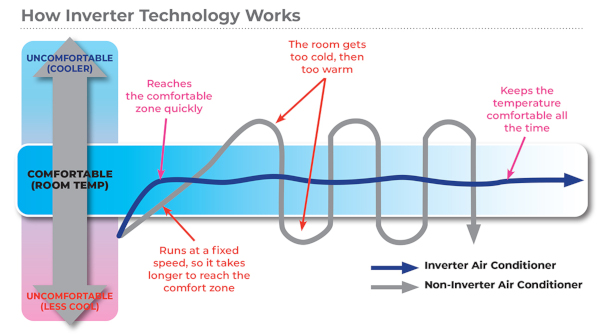

“We believe that improving efficiency is foundational for a decarbonized future,” said Deshmukh. “Trane’s R-454B heat pump offerings provide a 4.5% increase in heating and cooling efficiency. In addition to greater efficiency, we are also introducing new 24V inverter-driven systems and a new lineup of low-profile side discharge heat pump models, all of which offer customers more systems eligible for tax credits and rebates.”

LG also believes that electrification and decarbonization will continue to be important, with Scarbrough noting that states embracing these trends will continue to do so, regardless of federal funding. For example, he noted that California, New York, and Massachusetts will continue to promote electrification incentives.

“We as an industry also need to focus more on artificial intelligence and how we can incorporate AI into our controls and into our equipment, along with what I see as a subset of electrification and decarbonization,” said Scarbrough. “It’s also important to focus on domestic hot water heating —especially as we move toward a 2030 code mandate to ban electric resistance hot water heating, and in some instances, like California, it’s happening sooner. To me, domestic hot water and how we transition that to heat pumps will grow — and that’s a real opportunity. The adoption of heat pump HVAC has been slower based on first cost, which is where domestic water heater can help in that transition.”

There are definitely challenges for the HVAC industry in 2025, including adapting to new refrigerant technologies and navigating economic pressures. However, there are a number of opportunities as well. Manufacturers remain optimistic that their substantial investments in the refrigerant transition, including contractor training and support, will ease the adoption of A2L systems. In addition, incentives provided by the IRA will hopefully drive demand, paving the way for growth this year and laying a strong foundation for continued growth in the years ahead.

Whether you require installation, repair, or maintenance, our technicians will assist you with top-quality service at any time of the day or night. Take comfort in knowing your indoor air quality is the best it can be with MOE heating & cooling services Ontario's solution for heating, air conditioning, and ventilation that’s cooler than the rest.

Contact us to schedule a visit. Our qualified team of technicians, are always ready to help you and guide you for heating and cooling issues. Weather you want to replace an old furnace or install a brand new air conditioner, we are here to help you. Our main office is at Kitchener but we can service most of Ontario's cities

Source link