As the construction industry barrels into 2026, the mood is one of cautious optimism – tempered by workforce challenges, shifting policy winds, and the relentless march of technology. On Thursday, the Associated General Contractors of America (AGC) and tech firm Sage unveiled their annual Construction Hiring & Business Outlook, offering the clearest view yet into how construction firms are bracing for the year ahead.

According to new AGC analysis, 32 states and the District of Columbia added construction jobs between November 2024 and November 2025. Texas led the pack, adding 24,000 jobs, followed by North Carolina, Ohio, Minnesota, and Michigan. Iowa took the crown for the biggest percentage gain, nearly 10%. But that growth wasn’t universal: New York and New Jersey shed the most jobs, and some states – like Arizona and Alabama – saw notable monthly declines.

“We’re seeing soaring demand for data centers, power, and other select segments,” said Ken Simonson, AGC’s chief economist, during the media briefing. “But uncertainty over tariffs and policy shifts is causing many owners to hold back, leading contractors to trim their headcount.”

That uncertainty is showing up in backlogs and hiring plans. While many firms remain optimistic – especially in industrial and infrastructure work – there’s a clear sense that the good times aren’t spread evenly.

Immigration’s Outsize Role in Construction Labor

Ken Simonson, AGC’s chief economist, underscored just how dependent the construction industry is on foreign-born workers. “An analysis of the 2024 American Community Survey found that 35% of construction craft workers were foreign born,” Simonson explained. “That’s about double the 18% of the total U.S. workforce that is foreign born.” The numbers vary widely by state: in places like California, Texas, Maryland, New Jersey, and the District of Columbia, half or more of all craft workers are foreign born. In contrast, northern states and areas like West Virginia see single-digit percentages.

Simonson noted that construction workers are often more mobile than those in other industries, moving to where the work is. “This is an issue for all contractors, potentially, if there is a tightening of immigration enforcement and closing down of the borders.” He referenced a recent Congressional Budget Office analysis, which warned that if immigration slows or stops, the U.S. population may begin to decline as early as 2030, with deaths outnumbering births. “Not just the construction industry, but the economy as a whole is going to be more and more dependent on foreign-born workers,” Simonson added.

That’s why AGC is pushing for legal pathways to bring in foreign-born workers and making sure contractors can utilize those already here legally – steps the association sees as vital to the industry’s future.

The AI Boom and the Data Center Surge

Julie Adams, a spokesperson for Sage, the construction tech firm, highlighted one unmistakable trend: the explosive growth in data center construction, fueled by the artificial intelligence boom. “As businesses race to build the computing infrastructure needed to power AI applications, they’re creating unprecedented demand for specialized construction projects,” Adams said.

That surge couldn’t come at a better time for some firms facing labor shortages and operational headaches. Sage’s data shows 61% of construction firms now use AI or plan to increase investments in it – up sharply from last year. The most common use cases? Office and admin work, estimating, design, and even recruitment.

“We’re at an inflection point,” Adams said. “AI is both driving demand and reshaping how construction firms operate. Those who embrace these technologies will be best positioned to capitalize as adoption accelerates.”

Subcontractors: The Steady Engine Beneath the Surface

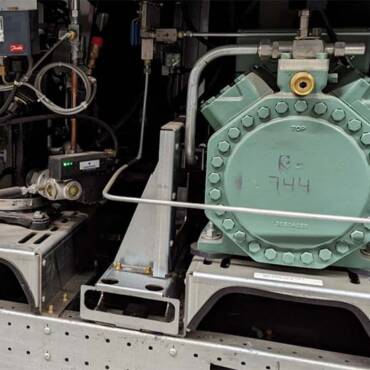

Amid all the volatility, one part of the industry remains a bedrock: specialized subcontractors, particularly in HVAC and sheet metal. Despite worries about labor supply and shifting demand, these trades are holding steady – and in many markets, thriving.

Arch Willingham, president of T.U. Parks Construction in Chattanooga, Tennessee, put it plainly. “We’re not having any issue getting subs. Our subs are healthy,” he said. Willingham remembers tougher years when one sub after another would go under. “They’re all going pretty well. None of it is like it was post-COVID, but the backbone is strong.”

That view was echoed by contractors across the Midwest and Southeast, where industrial and infrastructure projects are surging. “The skilled trades performing the work are a key point,” said Kyle Van Slyke, COO of Musselman & Hall Contractors in Kansas. “We’re seeing steady optimism, especially in the industrial and utility sectors.”

For all the promise, headwinds loom. Contractors report that tariffs and the threat of stricter immigration enforcement – especially under a Trump administration – are creating anxiety and making workforce planning harder. Yet, on the ground, the real-world impact of tariffs remains muted for many. “Owners ask us about tariffs, but we really haven’t seen prices changing as a result,” Willingham said. “It’s more of a marketing thing from suppliers.”

For all the promise, headwinds loom. Contractors report that tariffs and the threat of stricter immigration enforcement – especially under a Trump administration – are creating anxiety and making workforce planning harder. Yet, on the ground, the real-world impact of tariffs remains muted for many. “Owners ask us about tariffs, but we really haven’t seen prices changing as a result,” Willingham said. “It’s more of a marketing thing from suppliers.”

Still, AGC’s leadership is pushing for action on several fronts: expanding legal work visas for construction, boosting funding for technical training, and pressing Congress to reauthorize key infrastructure programs before current legislation expires in September. “With supportive infrastructure funding, workforce investment, trade and permitting policies in place, construction can continue to grow the economy and expand access to high-paying career opportunities,” said AGC CEO Jeffrey Shoaf.

A Patchwork Outlook: Resilient Subs, Cautious Owners, and a Race for Talent

What emerges from this year’s outlook is a patchwork: explosive growth in data centers and select infrastructure, hesitancy in private commercial construction, and a fierce competition for skilled labor – particularly as senior leaders retire and aren’t easily replaced.

Yet, in the trenches, subcontractors remain resilient. Despite all the noise about economic headwinds and policy shifts, HVAC and sheet metal contractors – and many of their peers – are still busy, still hiring, and still essential.

As Van Slyke put it, bringing things back to the basics: “There’s optimism about growth for the overall industry. Firms are still looking to find people and get ready for the work.”

For an industry used to boom-and-bust cycles, that quiet confidence might be the biggest news of all.

Workforce Innovation: From Word-of-Mouth to Career Centers

Yet, that confidence isn’t without its caveats. Labor remains a persistent challenge – and some markets are taking matters into their own hands. In Tennessee, T.U. Parks Construction’s Arch Willingham points to a $10 million investment in a local Construction Career Center, spearheaded by their AGC chapter and executive Leslie Gower. “We got tired of staffing by word-of-mouth – asking superintendents if they knew anyone at church who could show up on time,” Willingham said. “That’s not how you build a skilled, safe workforce in a technical industry.” The new center now puts more than 100 young people a year directly into construction jobs – a model that’s already delivering results in a tight labor market.

Margins, Backlogs, and a Measured Optimism

Jim Rhodes, CEO of Wayne Brothers Companies, echoed the broader sentiment: backlog and revenue remain strong, especially for firms focused on data centers, manufacturing, and institutional projects. “We’re a little more optimistic on 2026 than the report would suggest – not because of the numbers, but because of conversations we’re having with clients and banks,” Rhodes said. He noted that, while margins are compressed and contractors are still chasing fewer projects, there’s hope that long-stalled developments are finally moving forward.

The key, Rhodes emphasizes, is focusing on what you can control: improving processes, delivering value more efficiently and in a way that’s differentiated, and building a workforce that is eager, growing, and well-trained.

Whether you require installation, repair, or maintenance, our technicians will assist you with top-quality service at any time of the day or night. Take comfort in knowing your indoor air quality is the best it can be with MOE heating & cooling services Ontario's solution for heating, air conditioning, and ventilation that’s cooler than the rest.

Contact us to schedule a visit. Our qualified team of technicians, are always ready to help you and guide you for heating and cooling issues. Weather you want to replace an old furnace or install a brand new air conditioner, we are here to help you. Our main office is at Kitchener but we can service most of Ontario's cities

Source link