On September 30, the U.S. Environmental Protection Agency (EPA) proposed changes to its Technology Transitions Rule (TTR) as part of its broader efforts to “reconsider” existing climate policies. It also factored in recent objections to the original rule, namely by the FMI | The Food Industry Association, which claimed in a lawsuit that the original compliance deadlines placed excessive burdens on small grocers making the refrigerant transition.

Stakeholders in the HVACR industry have until November 17 to comment on the proposal.

Original TTR

The EPA finalized its original TTR in 2023, under the authority of the AIM Act of 2020. The rule established sector-based GWP limits across all key HVACR-related equipment sectors that use high-GWP HFC refrigerants.

The framework of the original TTR was the culmination of a decade-long process of phasing down HFCs globally and in the U.S. As a result, it incorporated direct feedback and recommendations from stakeholders across all sectors, including food retail, where many are actively working toward their own corporate sustainability goals.

Per the TTR’s compliance deadlines, some key regulations have already taken effect in 2025. These include the 700 GWP limit on residential and light commercial air conditioning and heat pump equipment, and the 150 GWP limit on self-contained refrigeration.

Recent data suggests that these sectors have not only transitioned successfully to lower-GWP refrigerants but are also experiencing associated business benefits. For example, Heating, Air-conditioning & Refrigeration Distributors International (HARDI) reported that as of July, 82% of air conditioning and heat pump shipments were for A2L-based equipment — up from 13% in January. A recent ATMO report also noted that 4.6 million self-contained R-290 cabinets are installed in North America.

Although the new EPA proposal upholds the sector-based GWP limits of those that have already taken effect, it recommends significant delays for transitions that had been planned for the next several months.

Looking for quick answers on air conditioning, heating and refrigeration topics?

Try Ask ACHR NEWS, our new smart AI search tool.

Ask ACHR NEWS

Proposed TTR

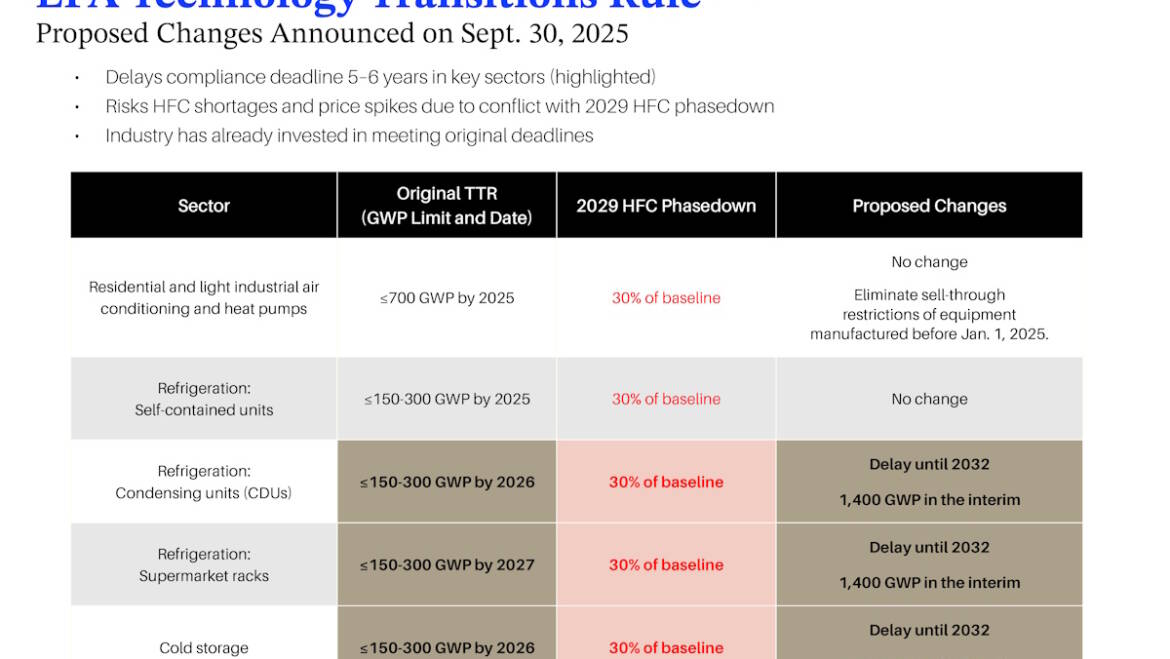

The EPA’s proposed changes to the TTR extend compliance deadlines five to six years, while raising GWP limits across key sectors in the interim. Some of these changes are detailed below.

Retail food, supermarket racks:

- Original rule: 150 GWP limit for new supermarket systems with 200 or more lbs. of refrigerant and 300 GWP limit for less than 200 lbs., starting January 1, 2027.

- Proposed changes: 1,400 GWP limit for new supermarket systems, starting January 1, 2027; 150 to 300 GWP limit (depending on charge size), starting January 1, 2032.

Retail food, condensing units:

- Original rule: 150 GWP limit for new condensing unit systems with 200 or more lbs. of refrigerant and 300 GWP limit for less than 200 lbs., starting January 1, 2026.

- Proposed changes: 1,400 GWP limit for new condensing units, starting January 1, 2026; 150 to 300 GWP limit (depending on charge size), starting January 1, 2032.

If implemented in retail food sectors, the interim 1,400 GWP limit would allow HFCs such as R-448A/R-449A to be used through 2032. R-448A/R-449A is considered a lower-GWP HFC alternative to R-404A, which was phased down through previous state-led efforts.

Cold storage warehouse equipment:

- Original rule: 150 GWP limit for new equipment with 200 or more lbs. of refrigerant and 300 GWP limit for less than 200 lbs., starting January 1, 2026.

- Proposed changes: 700 GWP limit for new equipment, starting on January 1, 2026; 150 to 300 GWP limit (depending on charge size), starting on January 1, 2032.

For residential and light commercial air conditioning and heat pump systems, the proposed changes call for removing the installation and/or sell-through restrictions of legacy HFC manufactured or imported before January 1, 2025.

In addition, the new EPA proposal included modifications to the following sectors:

- Refrigerated transport — intermodal containers: changes the exemption temperature from -50°C to -35°C.

- Industrial process refrigeration: extends the compliance date for equipment with a refrigerant charge of 100 lbs. or less used in the manufacture of semiconductors, from 2026 or 2028 to 2030. Also extends compliance dates for refrigerated centrifuges and laboratory shakers from 2026 to 2028.

Notably, the EPA did not propose changes to the original rule for other sectors, which still face near-term GWP reductions:

- Stationary variable refrigerant flow (VRF) air conditioners and heat pumps: 700 GWP limit with an installation compliance date of January 1, 2027;

- Data centers, computer room air conditioners, and information technology cooling: 700 GWP limit as of January 1, 2027;

- Automatic commercial ice machines (smaller sizes): 150 GWP limit as of January 1, 2026;

- Food processing and dispensing equipment: 150 GWP limit as of January 1, 2027; and

- Ice cream makers: cannot use 38 restricted refrigerants as of January 1, 2028.

PROPOSED CHANGES: EPA’s proposed TTR extends key refrigerant deadlines and raises interim GWP thresholds. (Courtesy of Copeland)

Industry Challenges

The new TTR proposal raises concerns over the ability to align demand for HFCs with the global phasedown schedule, particularly in the retail food refrigeration sector. Extending compliance across key sectors to 2032 as proposed — with a 1,400 GWP threshold for food retail — would directly conflict with the global HFC phasedown established under the AIM Act.

The next step in the HFC phasedown will be in 2029, which will mandate a reduction of supplies down to 30% of the baseline levels. If implemented as proposed, these competing policies could cause demand to outpace supply. Rather than mitigating future refrigerant shortages and price spikes, extending HFC usage another five to six years could have the opposite effect, including:

- Potentially intensifying refrigerant pricing and availability pressures for servicing existing systems throughout their useful lifecycles; and

- Increasing the potential for stranded assets and early equipment obsolescence.

This raises the question: will there be enough new 1,400 GWP (i.e., R-448A/R-449A) supplies to satisfy increased demand, while staying under the HFC phasedown cap? Refrigerant recovery efforts would need to be practiced and enforced much more rigorously.

Although industry stakeholders can comment on this proposal through November 17, much of the industry has already prepared for the January 1, 2026, compliance deadlines of the final rule, which are currently in effect. For example, new lower-GWP remote condensing units are already entering the distribution channel as planned to meet the January 1, 2026, installation date requirement. If this timeline is delayed by six years as proposed, it could create confusion and potentially strand much of the lower-GWP inventories, as demand for these units might decrease.

From a manufacturing standpoint, the wheels supporting a transition to lower-GWP equipment are already in motion. Significant advancements and investments have been made in the past five years, including an improvement in the efficiency and performance of CO2 refrigeration systems. The industry is also preparing to launch A2L-optimized racks and condensing units.

Most manufacturers in the equipment supply chain have begun sunsetting their legacy HFC offerings. Reworking and restoring these production/manufacturing lines during the interim extension period could incur significant additional costs, which could ultimately be passed on to the end users of this equipment.

Balanced Path

As the EPA states in their reconsideration of the TTR, their goal was to provide flexibility by extending compliance deadlines. However, any short-term benefits could soon be offset by the collective potential for HFC shortages, stranded assets, and other unforeseen supply chain disruptions. Copeland empathizes with the challenges facing small grocers but believes that user-friendly, lower-GWP equipment options, which are cost-competitive with legacy HFC systems, are available today.

Collectively, our industry has already made significant investments, utilizing the opportunities to enhance system reliability, performance, and efficiency — with added application flexibility. We hope that the EPA recognizes the significant progress that has been made and upholds much of the original framework of the TTR. We believe it’s in the industry’s best interest to reconsider the proposal to balance short-term challenges with longer-term, and long-standing, priorities.

Whether you require installation, repair, or maintenance, our technicians will assist you with top-quality service at any time of the day or night. Take comfort in knowing your indoor air quality is the best it can be with MOE heating & cooling services Ontario's solution for heating, air conditioning, and ventilation that’s cooler than the rest.

Contact us to schedule a visit. Our qualified team of technicians, are always ready to help you and guide you for heating and cooling issues. Weather you want to replace an old furnace or install a brand new air conditioner, we are here to help you. Our main office is at Kitchener but we can service most of Ontario's cities

Source link