HVAC professionals’ loyalty to residential equipment brands, and to the companies that distribute equipment, has been slipping over the last few years, comparisons of biennial surveys taken since 2017 show.

In a 2017 survey of HVAC workers who choose the equipment their companies buy, or who influence those choices, 70% said they were very unlikely or unlikely to change primary brands within the next 12 months. In this year’s survey, that dropped 15 points, to 55%. The proportion of respondents who said their company was very likely to change brands was at 6% in each of the five surveys.

Loyalty toward HVAC distributors was weaker, and its falloff between 2017 and 2025 more pronounced. Some 43% of respondents to the 2017 survey said they were very unlikely or unlikely to change suppliers within the next 12 months, but that dropped to just 25% in this year’s survey. A larger proportion of this year’s respondents, 35%, said they were either likely or very likely to change distributors, while the remaining 40% said they were as likely to change as they were to not change.

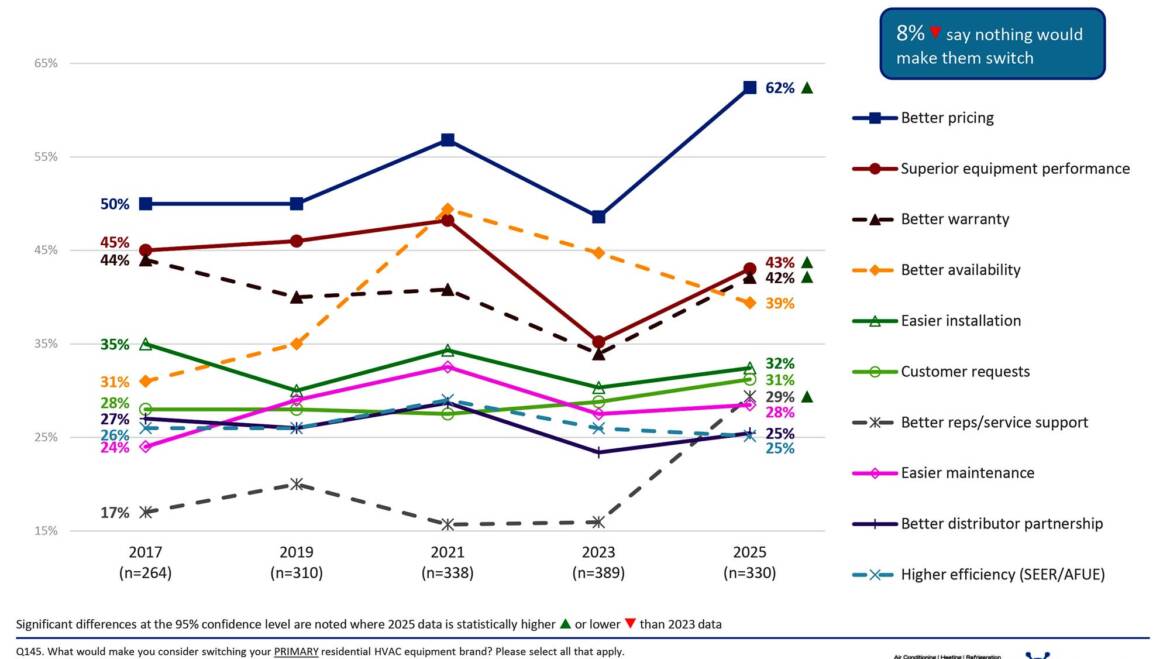

Residential Reasons to Switch Primary Brand

Price has become influential being a main driver to switching residential HVAC brands in 2025. Also on the rise, superior equipment performance and better warranty are highly influential. Though still important, influence of better availability continues to slightly decline following a high in 2021. Overall, more residential professionals are willing to switch brands this year, with only 8% saying nothing would make them switch.

Click chart to enlarge

SHIFTING REASONING: This chart illustrates how different reasons for potentially changing primary equipment brands shifted in importance among HVAC professionals over an eight-year period. The question, asked in surveys taken every other year since 2017, was, “What would make you consider switching your primary residential HVAC equipment brand? Please select all that apply.” (Courtesy of myCLEARopinion Insights Hub)

– Joanna Buglewicz

president and owner,

Green Valley Heating and Cooling

‘This is the Future’

Joanna Buglewicz, president and owner of Green Valley Cooling & Heating in Green Valley, Arizona, said the falling loyalty illustrated in the surveys is consistent with what she’s seeing in the industry.

“The decline in both brand and supplier loyalty doesn’t surprise me, as it really comes down to price, product availability, and good, old-fashioned customer service,” Buglewicz said. “In recent years, inflation, inconsistent inventory, and shifting manufacturer incentives have made it harder for dealers to stay loyal to one brand, especially when their distributor can’t provide consistent support.”

“I think this is the future: No loyalty,” said Steve Schmidt, president of Frederick Air Inc., a contracting company based in Frederick, Maryland.

The five surveys compared in the study by myCLEARopinion Insights Hub, a B2B research firm and part of BNP Media Inc., parent company of The ACHR NEWS, were taken every odd-numbered year since 2017. Some 522 HVAC professionals responded to this year’s survey, and 330 answered the questions about the likelihood of changing brands and distributors.

Contractors cite a variety of reasons for moving to a different primary brand, including favorable pricing, superior equipment performance, and better availability. When it comes to selecting a distributor, contractors say they are looking for responsive companies that offer the training and product support they need.

Looking for quick answers on air conditioning, heating and refrigeration topics?

Try Ask ACHR NEWS, our new smart AI search tool.

Ask ACHR NEWS

Todd Flemmens, operations manager for HVAC and plumbing at Aero Energy, a home services company in Oxford, Pennsylvania, said the contractor-distributor relationship is behind the drop in brand loyalty.

“During the time frame of 2017 to 2025, the manufacturers experienced many changes, specifically government regulations requiring a transition to SEER2 and A2L,” Flemmens said “Any time you have this amount of change in manufacturing, you typically have some issues with the performance of the product, and distributor support is essential when navigating performance and warranty issues.”

Flemmens added: “I still believe the brand matters. However, I believe that the relationship between the distributor and the contractor matters more.”

When Aero chose Carrier, whose equipment line it had previously featured, as its primary brand in 2024, “the relationship with the distributor was a big factor,” Flemmens said. Areo’s relationship with its then-current distributor had soured, he said, and changes at its former distributor prompted a return to both that company and to Carrier.

“We are receiving much better service, e-commerce, software support, training, and tech support on the products we are purchasing,” Flemmens said.

Similarly, Green Valley’s relationship with a distributor prompted it to change primary brands, Buglewicz said, after more than 20 years with the same brand.

“We weren’t receiving the level of support from our distributor that we expected,” she said.

In 2018, Green Valley switched distributors and adopted Daikin as its primary brand. “It was absolutely the right decision for us,” Buglewicz said.

Schmidt, at Frederick Air, said loyalty slippage accelerated because of supply chain problems that began during the coronavirus pandemic.

“It was a matter of survival to seek other brands,” he said. “We were kind of forced to do something that was against our natural instincts of loyalty.” Frederick Air carried Bryant products since the contractor was founded more than 30 years ago, and still does, but picked up Rheem products in 2021 and Lennox within the past year, Schmidt said.

Shifting Reasons

The surveys also looked at the reasons HVAC professionals might change brands, and how those reasons have risen and diminished in importance across the industry over time.

Better pricing was the top reason for potential brand changes in all five surveys. But the proportion of respondents who said better pricing would prompt them to change brands rose from 50% in 2017 to 62% in 2025.

“In the past, I don’t think the price was such a motivator for us. We wanted good equipment and we wanted to give our customers quality,” said Schmidt. “Now our customers are looking for price.”

Better availability was cited by 31% of respondents in 2017 and reached a peak in importance in 2021, during the height of pandemic-related supply issues, when about 47% of respondents said better availability would cause them to change. Availability was the second most-cited reason in 2021 but the fourth most-cited reason this year, at 39%, behind better warranty (42%) and superior performance (43%) as well as better pricing.

“Superior equipment performance matters because no one wants to jeopardize their reputation by installing products that don’t hold up. But price continues to carry tremendous weight, especially as operating expenses climb,” Buglewicz said. “The two go hand in hand: Dealers want a product that performs well at a fair, sustainable price point.”

Purchase the full study from myCLEARopinion Insights Hub.

Whether you require installation, repair, or maintenance, our technicians will assist you with top-quality service at any time of the day or night. Take comfort in knowing your indoor air quality is the best it can be with MOE heating & cooling services Ontario's solution for heating, air conditioning, and ventilation that’s cooler than the rest.

Contact us to schedule a visit. Our qualified team of technicians, are always ready to help you and guide you for heating and cooling issues. Weather you want to replace an old furnace or install a brand new air conditioner, we are here to help you. Our main office is at Kitchener but we can service most of Ontario's cities

Source link