AI and digital tools are everywhere, and HVAC is no exception. But when it comes to researching new HVAC products on the market, contractors aren’t asking ChatGPT. They’re still getting most of their product information from traditional, trusted, human-centered sources.

According to a new unitary study from myCLEARopinion Insights Hub for ACHR NEWS, 68% of residential HVAC contractors said they got product info from manufacturer websites, while 60% said trade shows or industry conferences. 58% said distributors, and 51% said webinars or virtual events. Further down the list were industry peers or word of mouth (47%), search engines (45%), and industry associations (42%). Social media ranked down at 32%, just above podcasts (17%).

Taken together, the data shows that while digital tools are gaining ground, contractors still lean on the people and relationships that have long anchored this industry.

;

Distributors: Still the First Call

Contractors, especially on the residential side, rely on their distributors for both purchasing and product information, said David Holt, general manager of EGIA Contractor University. That trust, he added, is built on daily realities: Distributors handle returns, emergencies, stocking needs — things digital tools can’t replace.

“They trust their distributor first, because, really, that is where their relationship lives,” he said. “When we went from R-22 to R-410A, our Mingledorff’s rep was the first to show up with: ‘Here’s some refrigerant recovery machines that handle both refrigerants.’ He’s bringing us solutions to problems that he knew we were having to consider. So I think that’s the No. 1 reason for sure, on the residential side, that most contractors still rely heavily on their distributors, on their wholesalers, to provide them with the information — they’re trusted advisors.”

Zachary Perge at HARDI pointed to the results of HARDI’s second annual Voice of the Distributor survey, where members were asked to rate supplier performance on a 1–5 scale.

“It’s about a 3 — there’s certainly room for improvement there in terms of really understanding the product,” he said. “But I would say, they do rely very heavily on distributors and the suppliers for that.”

Distributors also reinforce this role through training.

Looking for quick answers on air conditioning, heating and refrigeration topics?

Try Ask ACHR NEWS, our new smart AI search tool.

Ask ACHR NEWS

“Essentially every distributor now offers in-person product training that is, by and large, done by those suppliers,” Perge said. “I was with a distributor last month that just opened a completely new live buyer lab with signage and new products that the contractors would be working on.”

Light-commercial contractors show similar habits, with slight shifts in order: In the ACHR NEWS study, manufacturer websites again ranked highest (72%), followed by manufacturer rep firms (69%). Distributors came in at 56%, with trade magazines and webinars tied at 53%.

Holt said the internet may offer unlimited information, but it can’t replicate the value contractors get from real relationships — a value he believes distributors are beginning to re-emphasize.

“The internet is the most amazing brochure on the planet,” Holt said, but creating value for contractors comes down to old-fashioned relationship-building. “I’m talking to an awful lot of distributors right now, and they are buying into the idea that, you know what, we do need to change a little bit about what we’re doing and how we’re doing it. We need to get more focused on that personal relationship that a lot of people have lost. The distributors that are successful in maintaining those personal relationships with contractors in their local area are going to wind up getting stronger and stronger.”

Residential Manufacturer Websites

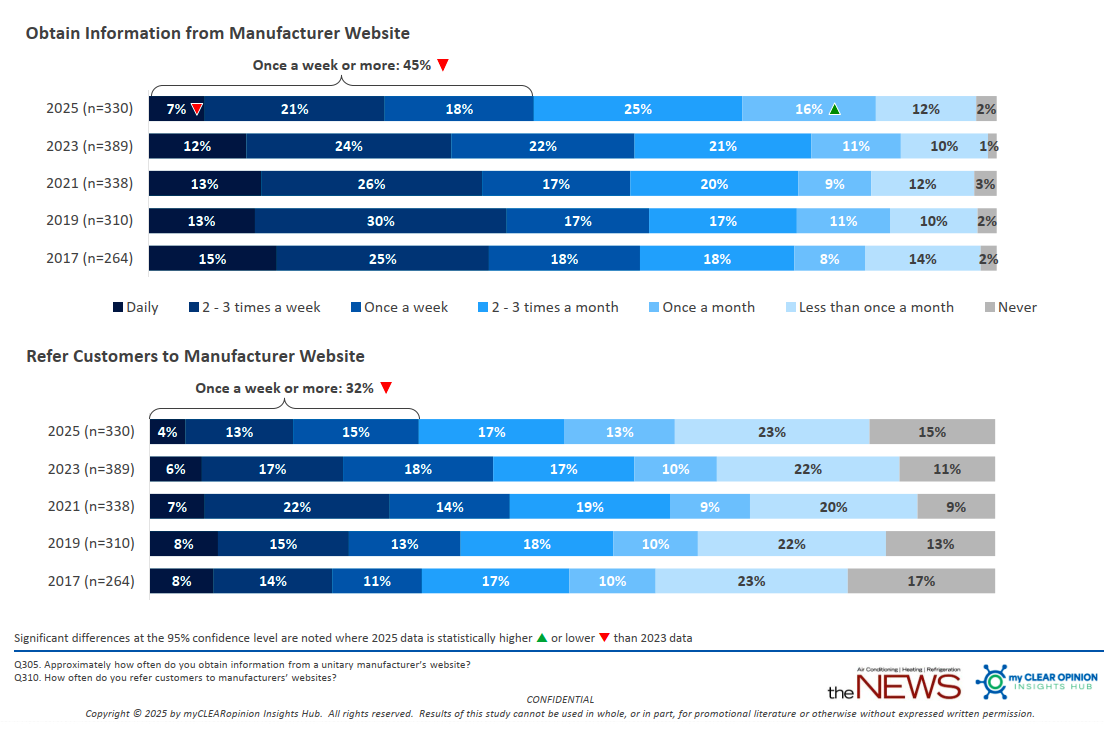

More than two-in-five residential professionals obtain information from a manufacturer website on a weekly basis. Professionals refer their customers to manufacturer websites less often by comparison.

Click chart to enlarge

DIGITAL TOUCHPOINTS: More than 2 in 5 residential HVAC professionals obtain information from a manufacturer’s website on a weekly basis. By comparison, they refer their customers to manufacturer websites less often by comparison. (Courtesy of myCLEARopinion Insights Hub)

;

The New HVAC Shopping Landscape

Those same preferences show up when it’s time to actually make a purchase. Traditional distributors still dominate, but the landscape is widening to include stronger e-commerce options, hybrid logistics players, and a growing number of internet-only suppliers.

The survey found that about half of residential HVAC purchases (52%) are currently made through wholesalers or distributors. After that came manufacturer direct (16%), mass merchants (12%), manufacturer’s reps (10%), and internet-only distributors (10%). Looking five years ahead, contractors expect to buy slightly less from traditional sources and slightly more from internet-only distributors — a 5% projected increase.

That shift may be modest, but it reflects contractors’ growing comfort blending digital convenience with long-standing supplier relationships.

One reason online-only HVAC distribution hasn’t taken a bigger market share, Perge said, is that traditional wholesalers have significantly improved their online capabilities in the past 5-10 years. Many now offer real-time inventory, online ordering, and same-day or overnight delivery that rivals pure-play e-commerce competitors.

“Most distributors, especially the good ones, have gotten very, very skilled with their e-comm platform and real-time inventory and pricing,” said Perge. “Distributor e-comm and same-day delivery, overnight delivery — they’ve certainly gotten much, much better at it.”

Still, online-only distributors have carved out a role — particularly in remote regions and among contractors with limited access to local branches.

“Say you’re in rural Montana and there might not be a distributor near you,” Perge said. “You’re mainly doing repair, not replace, and you just need some product … [or] you’re just trying to stockpile some simple inventory, like compressors, coils, cleaning products. Then I think there is a place for it.”

Price, however, is still a differentiator.

“I don’t know if you’ll always find that the pricing there is as competitive as you might see from a distributor,” Perge added. “But there’s certainly a fit in a lot of ways.”

What online-only sellers don’t provide is the suite of extras that contractors are accustomed to receiving from their local wholesaler. Holt described a distributor he recently met who built his entire business around centralized inventory and regular delivery routes — no counter staff, no territory managers.

“This guy covers four states with his distributorship,” he said. “His model doesn’t even include a parts counter or territory managers. It’s more about being convenient for the contractor — stocking a whole bunch of stuff in one place, getting it really well organized and structured as a distribution center, and having trucks making regular rounds.”

But that model comes with trade-offs.

“He’s not going to be very good at handling emergency calls because he’s not local,” Holt said. “Most of his customers are not right there in his backyard, which is why he doesn’t worry about having a parts counter.”

Holt expects more companies to adopt this kind of logistics-first structure.

“I think there will be more of that — more Amazon-ish type organizations that have a very good logistical kind of structure to their business,” he said. “It’s all about logistics when you’re moving cardboard boxes from point A to point B.”

;

AI: At Work Behind the Counter

Inside distribution, AI is quietly finding its place in routine decision-making.

Traditionally, how many units or parts to stock for the coming season was never an exact science.

“What happens a lot of times, right now, is intuition for the purchasing agent — ‘We used about 50 of those last year. Let’s get 55 this year,’ — and they miss it, and now they’ve got 50 of them sitting in the warehouse at the end of the season,” Holt explained.

AI changes that calculus.

“Data tells us a lot, right? And purchase data, weather data, it’s all numbers,” Holt said. “With AI, you can easily correlate data. … You can start looking at numbers and say, ‘We need 37 of these and 24 of those,’ and have them when a contractor calls.”

Many distribution software platforms already embed AI-driven purchasing recommendations, he said, helping ensure the right equipment is available at the right time.

Looking ahead, he believes AI will eventually help distributors identify when a contractor’s business is under stress.

“There will be early warning signals,” Holt said. “AI can analyze payment history and start to see, ‘Uh oh, this accounts receivable balance is getting higher than we’d like,’ and then think about what kind of training this person might need, because something is going on in their business that is causing them not to be able to pay their bills.”

Purchase the full study from myCLEARopinion Insights Hub.

Whether you require installation, repair, or maintenance, our technicians will assist you with top-quality service at any time of the day or night. Take comfort in knowing your indoor air quality is the best it can be with MOE heating & cooling services Ontario's solution for heating, air conditioning, and ventilation that’s cooler than the rest.

Contact us to schedule a visit. Our qualified team of technicians, are always ready to help you and guide you for heating and cooling issues. Weather you want to replace an old furnace or install a brand new air conditioner, we are here to help you. Our main office is at Kitchener but we can service most of Ontario's cities

Source link